An IT provider can be so much more than a helpdesk—with the right partner, you can increase revenue and show your clients that you care deeply about their data security. In the banking industry, an IT provider can be the difference between recovering from a cyberattack or closing your doors. Needless to say, picking the […]

Category Archives: Banking

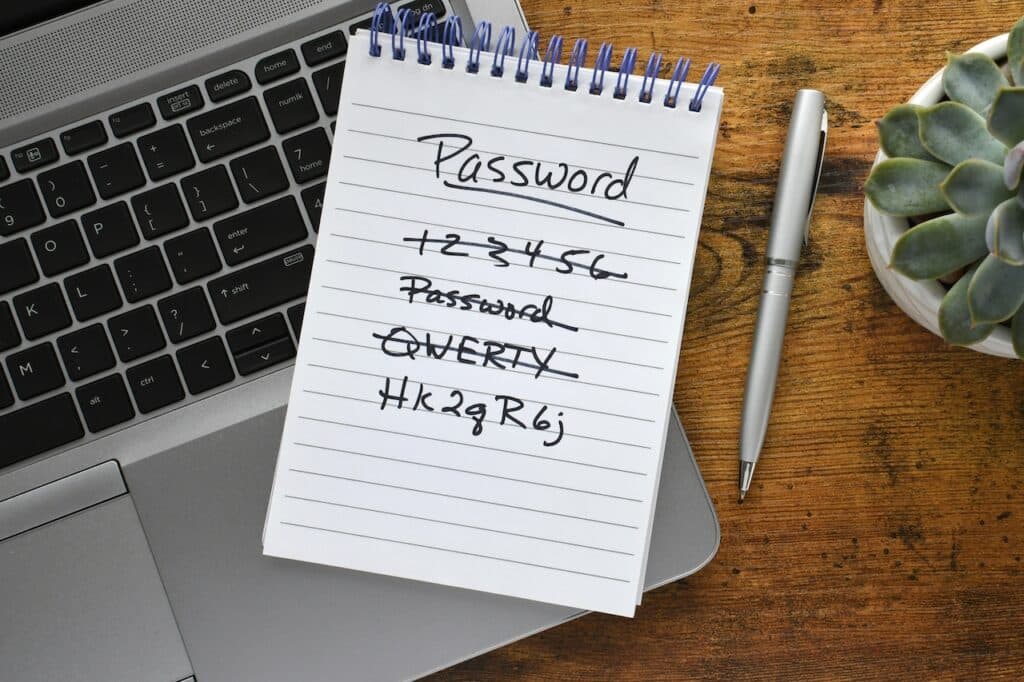

In March of 2022, TransUnion South Africa announced that their records had been breached—the group that took responsibility for the hack claimed that they stole 54 million records. They also claimed that the server they hacked was protected with the word “password.” It’s the oldest security joke in the book but if what the hacking […]

The hidden costs of a cyberattack are just that—hidden, below the surface, a ripple effect that can last for years to come. IT companies are quick to share stats about the average cost of a data breach (now at over $5 million) but what goes into those calculations? And is that just a loss of […]

You could already be outsourcing more than you realize—you might work with a cash management service or have someone take care of your payroll. And why do you outsource? Because you want to save your time for the things you do best! Instead of using your time and resources on troubleshooting network issues or keeping […]

Cybersecurity in banking is a constant barrage of new threats, changing regulations, and customer worries. And your financial institution is a prime threat. Your business goes right to the source: the customer’s money! To protect your customers and your business, your cybersecurity needs to be top-notch. But there may be some banking misconceptions that are […]

As a leader and decision-maker at your bank, you know that technology is a double-edged sword. It helps you work effectively, learn more about your customers, and make better decisions. But the online world also has the potential to destroy a business you’ve worked so hard to build. We live in a digital world—there’s no […]

Just as you have to complete due diligence before you buy a home, due diligence for banking vendors can make or break a partnership. Not completing enhanced due diligence (EDD) is like buying a house sight unseen and without doing an inspection! You never know what you might find. It only takes one cyberattack to […]

It feels like we live in a world of constant digital threats—one day you’ll read about a multi-million dollar loss from a global bank and hear the next about the billions of personal records that were leaked. As an employee or decision-maker at a bank, you may feel overwhelmed by the trust your customers have […]

Your cybersecurity nightmare has happened and your data is in the hands of criminals. Now what? You want to fix the problem as soon as you can, avoid expensive downtime, and protect your customers’ private data. How you respond to a data incident is critical. Your response time, communication practices, and remediation strategy will have […]

Silicon Valley Bank appears to have failed for a simple reason – mismatching of maturities of assets and liabilities . . . a basic bank management principle. Deposits were short-term and invested assets were long-term. When depositors wanted to withdraw their cash, the bank was faced with liquidating long-term investments (e.g., bonds, which were trading […]