The COVID-19 pandemic tested how prepared organizations were for the unexpected. Even before the pandemic, organizations needed to be ready for any number of potential disasters, both natural and man-made. The best way for community banks to address and manage unforeseen risks is to create a comprehensive business continuity and disaster recovery (BCDR) plan. This […]

A recent study by a Security Awareness Training platform showed that the average rate at which employees of small banks clicked on phishing emails was 25% (the rate for bigger banks is even worse!). Ransomware (malware that encrypts your data and only provides a decryption key if you pay a ransom) continues to be a […]

In the dynamic landscape of banking, one cornerstone remains critical to ensuring trust and credibility: compliance risk management. As financial regulators continue to prioritize consumer protection and global financial integrity, institutions must be equipped to manage compliance risks effectively. So, what does that look like for your bank? Here are some strategies for making risk […]

Community banks can find themselves in a tough spot when adopting new technology: on one hand, they need to move quickly and stay ahead of the competition; on the other hand, they don’t want to abandon their customer-first approach. That’s why a cloud banking solution could be key for community banks—it can help balance growth […]

What does it mean to be “threat ready” in an industry as sensitive as banking? The term is tossed around a lot. But what does that look like for your institution? In simple terms, being threat ready means having the right technology, trained staff, and proactive strategies in place to protect your bank’s assets from […]

In the dynamic and unpredictable world of banking, having a robust continuity plan is crucial for maintaining operations during times of crisis. Whether it’s a natural disaster, a cybersecurity breach, or a global pandemic, banks must be prepared to withstand disruptions and continue providing essential financial services to their customers. However, the success of a […]

An IT provider can be so much more than a helpdesk—with the right partner, you can increase revenue and show your clients that you care deeply about their data security. In the banking industry, an IT provider can be the difference between recovering from a cyberattack or closing your doors. Needless to say, picking the […]

Eighth annual list reveals managed service providers with vertical specialties. OVERLAND PARK, KS, July 20, 2023: RESULTS Technology ranks among the world’s Top 100 Vertical Market MSPs (http://www.channelE2E.com/top100) for 2023, according to ChannelE2E, a CyberRisk Alliance resource. The annual list and research report identify and honor the top 100 MSPs in healthcare, legal, government, financial […]

Annual MSP 501 Identifies Industry’s Best-in-Class Businesses Growing Via Recurring Revenue and Innovation JUNE 27th, 2023: RESULTS Technology has been named as one of the world’s premier managed service providers in the prestigious 2023 Channel Futures MSP 501 rankings. For the past 17 years, managed service providers around the globe have submitted applications for inclusion […]

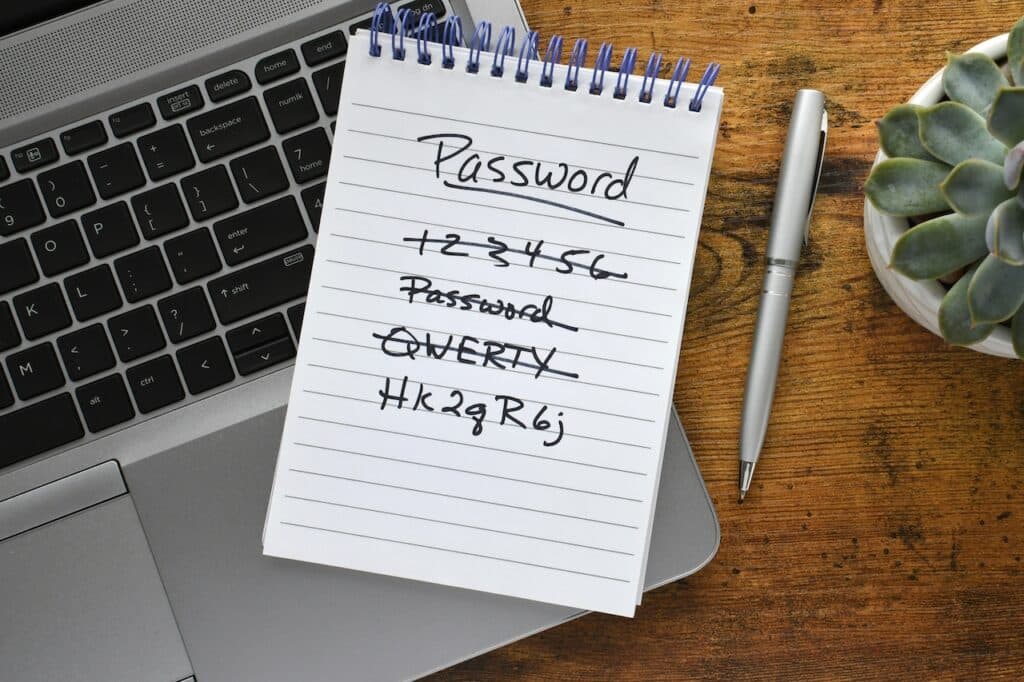

In March of 2022, TransUnion South Africa announced that their records had been breached—the group that took responsibility for the hack claimed that they stole 54 million records. They also claimed that the server they hacked was protected with the word “password.” It’s the oldest security joke in the book but if what the hacking […]